Buying Guide, Trends & Insights

2026 Market Trends for Stainless Steel Drinkware: Demand Forecast, Design Directions & Buyer Insights

Colors, Materials, Designs & Market Insights for Brands, Wholesalers, and OEM Developers

1. Executive Summary

The stainless steel (SS) drinkware market is entering a pivotal phase in 2026, driven by converging forces: sustainability imperatives, consumer appetite for reusable products, and innovation in design and engineering. According to Precedence Research, the global reusable water bottle market is projected to grow from approximately US$10.17 billion in 2025 to US$15.27 billion by 2034, underscoring the immense opportunity for high-quality stainless steel drinkware.¹ Meanwhile, Future Market Insights (FMI) forecasts that the stainless steel water bottle segment will expand at a compound annual growth rate (CAGR) of around 5.5% from 2025 to 2035.²

In 2026, we anticipate four major trend pillars shaping the SS drinkware industry:

-

Color Innovation — From earthy neutrals to metallic gradients and bold color-blocking.

-

Functional Design Diversity — Slim car-compatible tumblers, FreeSip two-way lids, oversized capacity, and modular lid systems.

-

Material & Coating Evolution — Recycled steel, 316-grade stainless, advanced powder coatings, and UV-printing.

-

Sustainability & Market Segmentation — Regional differentiation based on eco-concerns and consumer behavior across North America, Europe, APAC, and Middle East.

This trend report is designed for B2B stakeholders: OEM manufacturers, private-label brands, wholesalers, and corporate buyers. It delivers actionable insights, product-development recommendations, and commercial forecasts — all grounded in market research and design-forward thinking.

2. Global Market Landscape & Growth Drivers

2.1 Reusable Drinkware Market Size & Projections

The reusable water bottle market, which includes stainless steel, plastic, and other materials, is experiencing strong tailwinds. According to Precedence Research, it is expected to grow at a steady pace through 2034, reaching US$15.27 billion.¹ The driving forces include environmental consciousness, single-use plastic bans in many regions, and consumer shifts toward health and wellness.

Breakdown by material reveals that stainless steel is among the fastest-growing segments. Future Market Insights estimates the SS water bottle market to expand from US$1.5 billion in 2025 to US$2.6 billion by 2035, implying a robust CAGR of ~5.5%.² This forecast underscores stainless steel’s status as a premium, long-lifespan drinkware material favored by consumers and businesses alike.

Additionally, reports from Global Growth Insights predict a healthy rise in the insulated water bottle sector, valuing it at US$4.71 billion in 2024, expected to hit US$5.0 billion by 2026, with a CAGR around 6.08%.³ This aligns with consumers’ growing preference for products that preserve temperature — a key advantage of stainless steel.

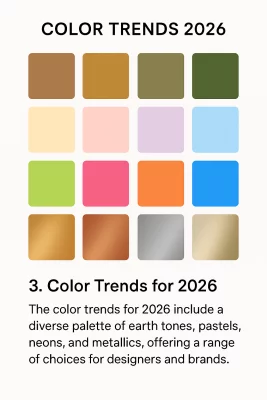

3. Color Trends for 2026

Color remains a primary differentiator for brands in the competitive drinkware space. In 2026, we project five dominant color directions, each aligned with distinct market segments and consumer preferences.

3.1 Nature-Inspired Neutrals

Earthy, grounding tones will see strong uptake in 2026. Shades like Sand Beige, Clay Tan, Moss Green, Olive, and Ash Brown resonate with wellness, minimalism, and outdoor lifestyles.

-

Target Consumers: Outdoor enthusiasts, eco-conscious buyers, corporate gift buyers seeking sophistication.

-

Design Implication: These tones pair well with matte or soft-touch finishes and promote a “timeless” aesthetic.

3.2 Soft Pastels

Soft pastels remain highly relevant, especially among younger and female consumers. Colors like Lilac Mist, Mint Whisper, Rose Quartz, Dusty Coral, and Baby Blue are popular on social media platforms, driving visual appeal in lifestyle and travel collections.

-

Target Consumers: Millennials, Gen Z, campus communities, fashion-conscious users.

-

Design Implication: Pastel shades perform well with powder coatings and subtle pearl finishes, giving a delicate yet durable finish.

3.3 High-Saturation Punch Colors

Bold color palettes — Electric Blue, Flame Red, Neon Green, Cyber Yellow, Hot Pink, and Ocean Turquoise — are gaining traction in 2026, particularly in markets like North America and the Middle East. These colors align with streetwear influences, sports aesthetics, and youth culture.

-

Target Consumers: Lifestyle brands, fitness and outdoor communities, younger demographics.

-

Design Implication: High-saturation finishes require high-quality powder or spray coatings to maintain vibrancy and durability.

3.4 Metallic & Pearlescent Finishes

Premium metallic finishes will surge in popularity in 2026. Hues such as Ice Blue Metallic, Champagne Gold, Gunmetal, Pearl White, and gradient metallic tones will be especially favored by upscale brands and corporate gift lines.

-

Target Consumers: Luxury / premium segment, corporate gifting, limited editions.

-

Design Implication: Factories must invest in refined spray or powder coating processes, plus anti-scratch topcoats, to ensure finish longevity.

3.5 Color-Blocking & Multi-Tone Combinations

Color-blocking remains a critical trend, heavily influenced by leading brands like Owala and Hydro Flask. Designers will push for dual-tone lids, multi-tone bodies, triple-color combos, and contrast accents that strengthen brand identity and social media appeal.

-

Target Consumers: Gen Z, lifestyle and fashion brands, social media–focused buyers.

-

Design Implication: Requires precise production control, especially in coating registration, lid design, and part assembly.

4. Shape & Functional Design Trends

Product functionality is shifting significantly — not just for aesthetics, but to meet diverse use cases. In 2026, successful drinkware will combine versatility, ergonomics, and portability.

4.1 FreeSip Two-Way Drinking Systems

The dual-lid “FreeSip” model — combining a straw and a chug/flip spout — remains a top structural trend. This design meets three major use cases:

-

Active Use: Straw for gym or sports.

-

Everyday Hydration: Flip cap for quick sip.

-

Kids: Spill-resistance + convenience.

-

Why It Works: Versatility, social media “shareability” (Instagram Reels, TikTok), and strong brand differentiation.

-

Manufacturing Note: Requires precision mold engineering, high-quality silicone seals, and reliable hinge mechanisms.

4.2 Slim, Car-Compatible Tumblers

With daily commuting and travel demand rising, slim tumblers built to fit standard vehicle cup holders will be a core design pillar.

-

Typical Specs: 12–24 oz capacity, narrow base (≈ 7–8 cm), lightweight body.

-

Use Cases: Office commuters, road trips, coffee / tea on the go.

-

Value for OEMs: Lower material cost per unit, but demands tight tolerances and stable lid fitting.

4.3 Lightweight Structural Design

One of 2026’s biggest design drivers is weight reduction without compromising thermal performance. Brands will increasingly push for:

-

Thinner stainless steel walls

-

Reinforced necks for strength

-

PP, Tritan, or hybrid lids

-

Re-engineered bottom profiles for stability

This trend is particularly appealing to:

-

Female consumers

-

Travelers

-

Children

-

Minimalist lifestyle buyers

4.4 Oversized High-Capacity Tumblers

Large-capacity cups, such as 40 oz, 50 oz, or even 64 oz, will remain prominent, especially in North America. These tumblers are being redesigned for better grip, lighter weight, and more ergonomic handling.

-

Why: Social media culture (e.g., Stanley challenge), increasing demands for all-day hydration, and outdoor/adventure usage.

-

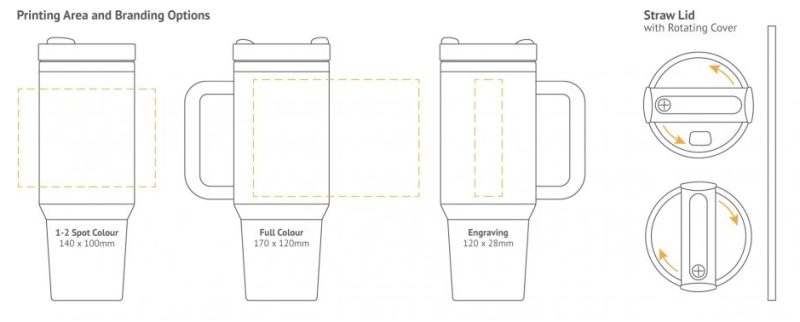

OEM Considerations: Need for reinforced structure, strong handles, leak-proof lids, and packaging adaptation for size.

4.5 Multi-Lid Modular Systems

Interchangeable lid systems are becoming mainstream. Brands will increasingly ship products with a lid kit (e.g., straw, flip, chug, sports).

-

Benefits: One bottle satisfies multiple scenarios → better perceived value, higher AOV (average order value) for B2B.

-

Challenges: Inventory management, SKU definition, mold costs for each lid type.

4.6 Ergonomic Carry Handles

Handles are not just functional but now design focal points:

-

Large curved handles: comfort + grip

-

Foldable handles: space-saving

-

Integrated handles: part of the lid

-

Silicone or soft-touch wraps: grip + style

These enhance usability for hiking, commuting, gym, and daily carry.

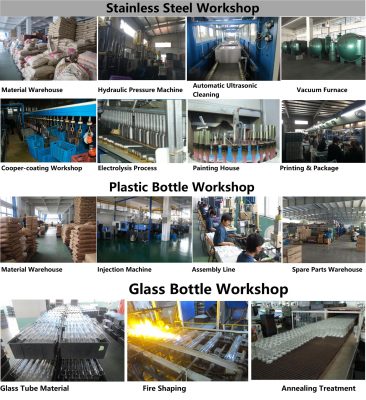

5. Materials, Coatings & Technology Innovation

Material innovation is the backbone of 2026’s drinkware revolution. Brands that leverage advanced alloys and finishes will lead.

5.1 Stainless Steel Grades: 304, 316 & Lightweight Alloys

-

304 Stainless Steel: Still the workhorse — cost-effective, high durability, and widely accepted.

-

316 Stainless Steel: Higher corrosion resistance, ideal for premium, marine, or beach-use bottles. Increasingly adopted in Europe and North America.

-

Lightweight Alloys: OEMs are experimenting with novel stainless steel blends to reduce weight by 10–20% while preserving strength — a key differentiator for travel and kids’ bottles.

5.2 Recycled Stainless Steel (Sustainable Focus)

Sustainability is no longer optional. The push for ESG-aligned supply chains is real:

-

Post-Consumer Recycled (PCR) Steel: Factories adopt PCR stainless steel, reducing carbon footprint and appealing to conscious consumers.

-

Recycled Lids: Use of recycled PP or Tritan in lids and external parts.

-

Traceability Systems: Brands increasingly require proof of recycled content from suppliers.

5.3 Advanced Coating & Printing Technologies

-

Powder Coating 3.0: Refined textures, stronger adherence, better color fidelity, improved scratch resistance.

-

Metallic & Pearl Finishes: Requires premium spray & topcoat processes to prevent chipping.

-

UV Digital Printing: Enables complex graphics, brand logos, and seasonal designs with high precision.

-

Wood-Grain Wrap Film: Offers a natural, warm aesthetic while retaining stainless steel’s strength and insulation.

5.4 Hybrid Material Designs: Tritan + Stainless Steel

Combining Tritan (or similar copolymers) with stainless steel offers:

-

Transparent measurement windows

-

Lower weight

-

High durability

-

Modern look

Perfect for children’s bottles, casual sports bottles, and lifestyle designs.

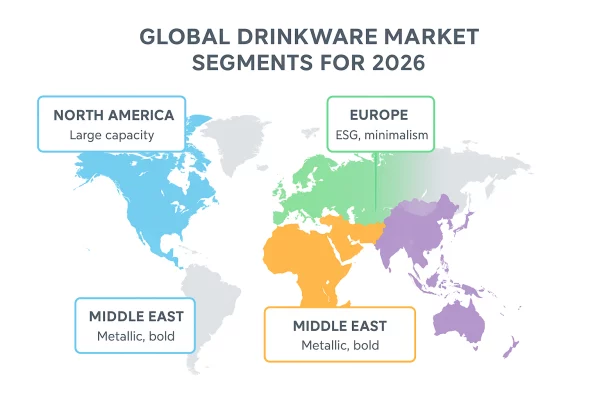

6. Global Market Segments & Consumer Behavior

Region-by-region analysis reveals how design and product strategy should vary according to consumer preferences and regulatory context.

6.1 North America (U.S. & Canada)

-

Leading Trends: Oversized tumblers (40–64 oz), dual-lid FreeSip systems, bold color palettes.

-

Drivers: Social media influence (TikTok / Instagram), eco-conscious commuting, fitness lifestyle.

-

Business Opportunity: Private-label brands, large-volume wholesalers, Amazon FBA sellers, corporate gifting.

6.2 Europe

-

Leading Trends: Recycled steel, 316-grade steel, minimalist aesthetics, muted earthy tones.

-

Drivers: Strong ESG awareness, strict regulations on single-use plastics, premium design culture.

-

Business Opportunity: Eco-brands, sustainability-led partnerships, high-end corporate gifts, boutique retailers.

6.3 Middle East & South Asia

-

Leading Trends: Metallic and high-saturation finishes, large capacities, flashy design.

-

Drivers: Rapid urbanization, strong gift-giving culture, demand for aspirational lifestyle products.

-

Business Opportunity: Regional distributors, luxury gift suppliers, event and occasion-based branding.

6.4 China & Southeast Asia

-

Leading Trends: Slim commuter tumblers, pastel and gradient colors, hybrid material bottles, foldable handle designs.

-

Drivers: Rising middle class, on-the-go culture, demand for design-forward portable bottles.

-

Business Opportunity: Local brands, corporate clients, influencer-led collections.

7. Pricing Trends & Cost Drivers in 2026

Understanding cost dynamics is essential for OEMs and brand developers as margins tighten and customer expectations evolve.

7.1 Material Cost Fluctuations

-

Stainless Steel: Global steel markets influence SS sheet prices; alloying costs (e.g., 316) higher.

-

Recycled Steel Premiums: Slightly more expensive due to recycling processes, but justified by ESG positioning.

7.2 Coating & Labor Costs

-

High-end coatings (metallic, pearl, UV print) can add 5–12% to production cost per unit.

-

Skilled labor for precise coating, especially for multi-tone or gradient finishes, increases factory overhead.

7.3 Freight and Logistics

-

Shipping costs remain volatile. OEMs should lock in freight early, especially for peak seasons.

-

LCL (less-than-container-load) vs FCL: Strategic planning of MOQs and shipping terms can dramatically impact landed cost.

7.4 Minimum Order Quantities (MOQs)

-

Many factories are offering more flexible MOQs in 2026 to accommodate emerging small brands and start-ups.

-

However, lid-kits and modular systems may require higher initial mold investment.

8. Recommended Product Strategies for 2026

Based on these trends and market dynamics, here are six product development opportunities with high potential for growth and differentiation in 2026.

-

Lightweight 40 oz Tumbler

-

Viral but optimized for weight.

-

Appeal: social media, all-day hydration.

-

-

Next-Generation FreeSip Bottle

-

Improved silicone seals, better flow, ergonomic design.

-

Appeal: dual-use, multi-scenario.

-

-

Slim, Car-Compatible 20 oz Tumbler

-

Narrow base, ergonomic shape.

-

Appeal: commuters, travelers.

-

-

Hybrid Tritan + SS Bottle

-

Transparent parts, modern aesthetic, light.

-

Appeal: children, families, fitness users.

-

-

Gradient Metallic or Pearl-Finish Bottle

-

Premium limited editions.

-

Appeal: retail, gifting, lifestyle brands.

-

-

Modular Lid Kit Bottle

-

Comes with straw, chug, flip, sports lids.

-

Appeal: value, flexibility, brand differentiation.

-

Additionally, ergonomic or foldable carry handles, and color-blocking body parts (base + lid + middle) can further elevate the design and user experience.

9. Risk Factors & Challenges in 2026

While opportunities are immense, there are also obstacles for both OEMs and brand developers:

-

Supply chain volatility: Steel price fluctuations, shipping rate spikes, and labor cost inconsistency.

-

Quality control: Complex lids, modular designs, and multi-tone coatings demand stringent QC and testing.

-

Sustainability trade-offs: Recycled materials may raise cost; traceability requirements can complicate procurement.

-

Competition: Many brands entering drinkware; differentiation is critical to avoid “me-too” products.

-

Regulatory pressure: Different markets may have varying material safety or import/export regulations (e.g., EU REACH, US FDA).

10. Strategic Recommendations for Brands & Manufacturers

To capitalize on 2026’s trends, here are several strategic recommendations for both OEM factories and brand developers:

-

Invest in R&D for material innovation

-

Explore lighter stainless steel alloys or hybrid materials.

-

Increase adoption of recycled steel to attract ESG-driven brands.

-

-

Build modular lid systems

-

Develop a lid-ecosystem (straw, chug, sport) to boost product versatility.

-

Leverage lid kits in B2B sales → higher order value, better product differentiation.

-

-

Optimize coating capabilities

-

Upgrade to next-gen powder-coating equipment.

-

Refine UV printing and metallic finishing to support premium SKUs.

-

-

Lean into regional segmentation

-

Design region-specific collections (e.g., pastel commuter tumblers for APAC, metallic gift bottles for Middle East).

-

Use local consumer research to guide color, capacity, and lid decisions.

-

-

Strengthen sustainability storytelling

-

Use recycled steel, sustainable packaging, and ESG certification.

-

Provide transparency (e.g., share recycled content percentages, supply chain traceability).

-

-

Enhance speed-to-market

-

Maintain streamlined sampling and prototyping workflows.

-

Offer flexible MOQs to support emerging or small-scale brand partners.

-

11. Conclusion

The 2026 stainless steel drinkware market presents a transformative opportunity for OEMs, private-label brands, wholesalers, and corporate buyers. Fueled by sustainability, design innovation, and consumer demand for reusable, high-quality products, this is a moment when differentiation matters more than ever.

-

Color: Earth tone neutrals, pastels, metallics, and bold hues all have space.

-

Function: Multi-lid systems, ergonomic forms, and high capacity remain key.

-

Materials: Recycled steel and premium alloys will define the next generation of drinkware.

-

Markets: Regional dynamics (North America, Europe, Middle East, APAC) shape demand.

Ifun, with its deep experience in OEM/ODM stainless steel drinkware, is well positioned to support brands. Whether you need help with mold development, color matching, lid engineering, or sustainable sourcing — we are ready to partner with you.

Ready to act on these trends? Contact us today for a free design consultation, sample development, or product roadmap meeting. Let’s build your 2026 drinkware collection together.

¹ Precedence Research, Reusable Water Bottle Market Report

² Future Market Insights, Stainless Steel Water Bottles Market Report

³ Global Growth Insights, Insulated Water Bottle Market Report